Carbon Credit Trading Scheme, 2023 – Key highlights

11 Sep, 2023

11 Sep, 2023

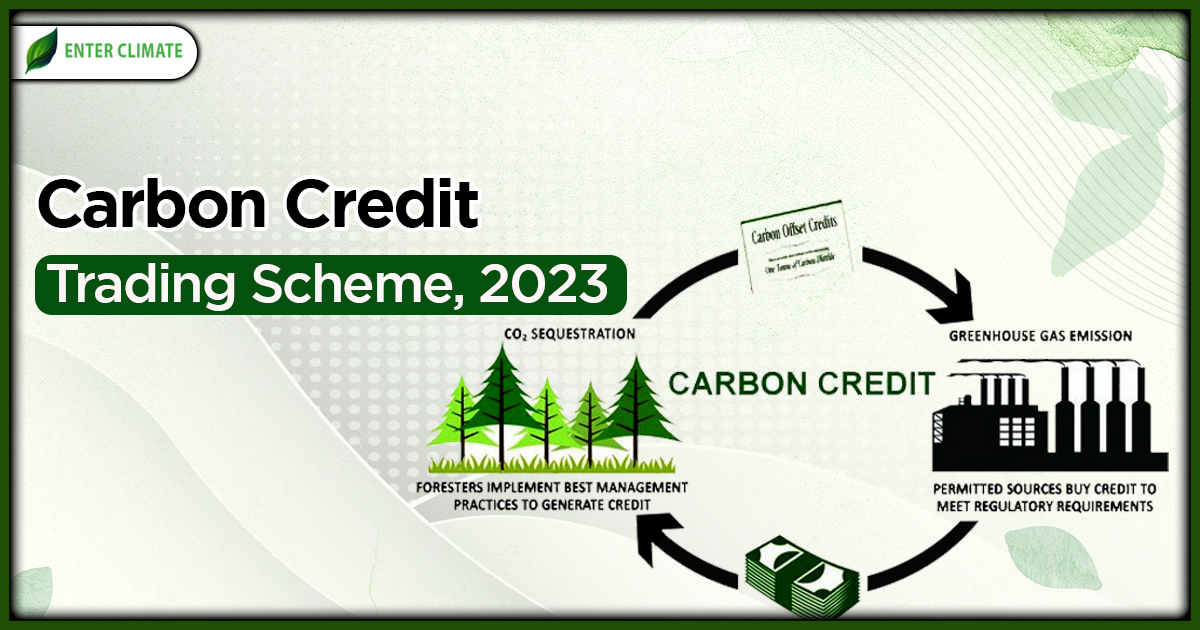

Despite significant advances in “clean” and ‘renewable’ energy technologies, India remains heavily dependent on fossil fuels. Conventional sources of power, such as coal and petroleum, release trapped CO2 into the environment, which is one of the most significant contributors to global warming across the globe. Every country across the globe is in search of innovative approaches to reduce GHG emissions, especially CO2. Though India is the leading country working towards sustainability, adopting greener technologies and renewable energy in its energy mix, the government has also realised the need to back this approach with a policy framework that incentivises such actions. The Green Credit Scheme, launched in June 2023, encourage the voluntary adoption of green technologies and activities, while the other credit-based policy framework, i.e. the Carbon Credit Trading Scheme (CCTS), aims to regulate a select group of industries responsible for substantial GHG emission and incentivise them for CO2 sequestration and adoption of green technology. In this article, we will talk about the key highlights of the CCTS policy and the concept of carbon Credit Trading.

What is the Carbon Credit Trading Scheme, 2023?

The Indian Parliament passed the Energy Conservation (Amendment) Bill 2022, which modifies the 2001 Energy Conservation Act. The Ministry of Power notified the Carbon Credit Trading Scheme 2023 and will soon notify entities obligated to comply with GHG emission regulations. To ensure that the identified entities’ percentage of total energy requirements come from non-fossil fuel sources, the government will release the modalities based on the Bureau of Energy Efficiency (BEE)[1] recommendations. MoEFCC will notify the emission intensity target for obligated entities upon the recommendation of the Ministry of Power. Emission intensity is the total amount of greenhouse gas emitted for every unit of GDP.

Obligated entities will earn a carbon credit certificate if they surpass the target assigned to them. The certificate will be issued by BEE. Obligated entities unable to achieve their target will be required to meet the shortfall by purchasing carbon credit certificates. Non-obligated entities may also register under the scheme and comply voluntarily. The scheme talks about focussing on domestic carbon credit trade in the country and unless India’s own climate goals are achieved, the government has prohibited the export of carbon credit. The highlights of the schemes include

Highlights of the Carbon Credit Trading Scheme

Covering approximately 72 per cent of India’s total CO2 emissions1, the Carbon Credit Trading Scheme, that will have far-reaching implications on India’s journey to net-zero carbon emissions by 2070. As the main design elements of the CCTS policy instrument are being deliberated, the main focus areas of the discussion include –

- Identifying which sectors to be included in the trading scheme,

- developing emission trajectories and targets for the sectors to be included and

- Developing mechanisms to ensure the stability of the carbon price.

Significant Highlights of the Policy

Carbon credits are the primary recommendation of Carbon Credit Trading Scheme, with a further recommendation of carbon taxes in the future. The policy aims to reduce greenhouse gas (GHG) emissions by setting emission intensity reduction targets for selected entities obligated under CCTS 2023, in alignment with India’s Nationally Determined Contributions (NDC).

The government also plans to develop the Indian Carbon Market (ICM), where a framework will be established to decarbonise the Indian economy by pricing the Green House Gas (GHG) emissions through trading of the Carbon Credit Certificates. The governance and oversight of the Indian Carbon Market (ICM) will be managed by the National Steering Committee or Indian Carbon Market (NSCICM), chaired by the Secretary of the Ministry of Power and co-chaired by the Secretary of the Ministry of Environment, Forests, and Climate Change.

Trading of carbon credits under the Carbon Credit Trading Scheme

Carbon credit certificates will be traded on power exchanges registered with the Central Electricity Regulatory Commission (CERC) for this purpose. CERC will also regulate carbon credit trading activities. The Grid Controller of India Limited (GCIL) will be the registry for the scheme. GCIL will

- undertake registration of obligated or non-obligated entities and

- maintain a record of transactions and share them with power exchanges and BEE.

Administrative mechanism

The central government will constitute a National Steering Committee, which will govern and oversee the overall carbon market. The Committee will be chaired by the Power Secretary and will have representation from several ministries, including Environment and Steel, and government entities, including BEE and GCIL. Key functions of the Committee include giving recommendations on certain matters to the BEE, formulation of procedures, rules, and regulations for the carbon market formulation of targets and issuance of carbon credit certificates.

BEE will administer the scheme functions, including identifying sectors and potential for emissions reduction, developing trajectories & targets for reduction and issuing carbon credit certificates.

The administrative purpose of Carbon Credit Trading Scheme includes

- To create an expressway for the decarbonisation of the Indian Economy.

- The scheme provides for a national steering Committee that will create further policies for the Carbon market in India. The policy will provide for the Greenhouse emission target.

- Monitoring reporting and verification (MRV) for the Carbon Market in India.

Role of governmental Agencies under the Carbon Credit Trading Scheme

- The Bureau of Energy Efficiency (BEE) will act as the administrator for the ICM, responsible for developing GHG emissions trajectory and targets for obligated entities.

- The Grid Controller of India Limited will be the designated agency for maintaining the ICM Registry and overseeing transactions among obligated entities.

- The Central Electricity Regulatory Commission (CERC) will act as the regulator for carbon credit trading. They will register power exchanges for trading carbon credit certificates, protect buyer and seller interests, and prevent fraud or mistrust.

- The compliance requirements under Carbon Credit Trading Scheme 2023 involve the Ministry of Power deciding on sectors and obligated entities that need to record and maintain GHG emissions data, recommending GHG emission intensity targets to the Ministry of Environment, Forests, and Climate Change, and obligated entities achieving these targets.

- Obligated entities that overachieve the targets will receive carbon credit certificates, while those that fail to achieve the targets will need to purchase carbon credit certificates from the ICM.

- The ICM framework aims to attract investments in GHG emissions reduction technologies and support India’s goal of achieving its updated NDC by 2030 and becoming net zero by 2070.

Carbon Capture Utilization and Storage (CCUS)

To achieve the desired climate mitigation target in general and attain the targets set out by India in COP26, the government needs a large-scale decarbonisation roadmap of various industrial sectors in India. Carbon Capture, Utilisation and storage (CCUS/ CCS) is one of the predominant techniques that the upstream Exploration and production (E&P) industry may take up to achieve these targets. The government released a policy framework known as the Carbon Capture Utilization and Storage (CCUS) in November 2022. The report is a comprehensive overview of CCUS, sector-wide emissions, capture and utilisation technologies, potential for CO2 storage, and policy frameworks that would be applicable for India to make carbon capture and hold a viable decarbonisation solution.

Relevance of CCTS in achieving Net Zero

GHG emissions affect our surroundings and our environment in many ways. India signed the Kyoto Protocol and took a pledge to overcome this arduous challenge and also reduce its carbon footprint in an accelerated manner. The CCTS is one of the many policies brought in this regard.

- A carbon credits-based policy is most suited for a developing country like India to incentivise CCUS adoption and bring down the cost of carbon capture, establish markets for low-carbon products and decarbonise India’s large and relatively young industrial asset base by offsetting carbon capture costs.

- GHG reductions require a multidimensional approach. This requires a robust legal framework that is able to regulate a carbon-offset market. Carbon credit trading represents a promising avenue for private entities in India to contribute to climate change mitigation while reaping significant benefits.

- By trading in such markets, business entities can unlock financial incentives, gain a competitive advantage, comply with regulations, foster technology adoption and innovation, and engage in international collaboration. Embracing carbon credit trading is not only a responsible choice but also a strategic move towards building a sustainable and prosperous future.

Conclusion

India is a developing country, and like every developing country, India is also a hub of industries. In the era of industrialisation, India also became a honeycomb of industries, especially core industries, which are sources of major pollutants, but to compete with other countries, it’s important to have core industries. India is the 3rd largest CO2 emitter on the earth. Some might argue that it indicates India’s growing industrialisation and economic might, and we are still far behind countries like the US and China. But the issue of global warming and environmental degradation across the globe shows that global warming is everybody’s problem. Extreme climate change and weather conditions are affecting every corner of the world in one form or another. The Carbon Credit Trading Scheme will play a crucial role in preserving the environment, along with our industrial sector, which has this golden opportunity to stand up and show the world how it is supposed to be done.

FAQs

The Carbon Credit Trading Scheme is a policy brought by the GoI in 2023 that aims to develop an India Carbon Market. The scheme will work towards assigning a value to the effort of reducing GHG emissions. The policy will assign a carbon credit to each tonne of carbon dioxide equivalent (tCO2e) reduced or avoided. These credits could be bought, sold and traded within the country’s carbon market framework.

A Carbon Credit is a permit that allows the company that holds it to emit a certain amount of carbon dioxide or other greenhouse gases.

One of the finest examples of carbon trading comes from the Delhi Metro Rail Corporation, which earned 19.5 crores from the sale of 3.55 million credits, which the DMRC collected over a period of six years showing that corporations are willing to comply with the trading protocols if a defined legal infrastructure exists.

A carbon credit policy will give a company the permission to emit a certain amount of carbon dioxide. Carbon offsets work to actively cancel out what is being produced. Carbon offset projects work to offset carbon emissions in various ways.

No, the trading is not banned in India. It started with the Kyoto Protocol in 2005. Those who removed/ sequestrated CO2 from the atmosphere were given Certified Emission Reduction (CERs). But when the prices of CERs fell, many Indian companies suffered losses, and the practice didn’t remain popular among corporations.

Yes, Carbon Credits are available in India for trade, with an estimated 26 million voluntary credits valued at around $150 million. However, as per the Energy Conservation (Amendment) Bill 2022, the carbon credits will not initially be available for export.

Taxability of the carbon credits is still a contentious issue in India. While the government is still deliberating on many aspects of how the policy will be executed, the Carbon Credit Trading Scheme, 2023, hints at taxation on the trade of carbon credits.

Read our Article: Get help with the legal exchange of Carbon Credits from our group of professionals at Enterclimate